2023 takeaways

For many, 2023 has been a challenging year in recruitment. There has been a downturn in placements, costs have increased, and insolvencies have been on the rise.

But it’s not all doom and gloom, there’s been some positives to 2023 with newly formed businesses flourishing despite the economic knock backs as well as established agencies taking the slow down as an opportunity to review their supply chain.

Downturn in placements

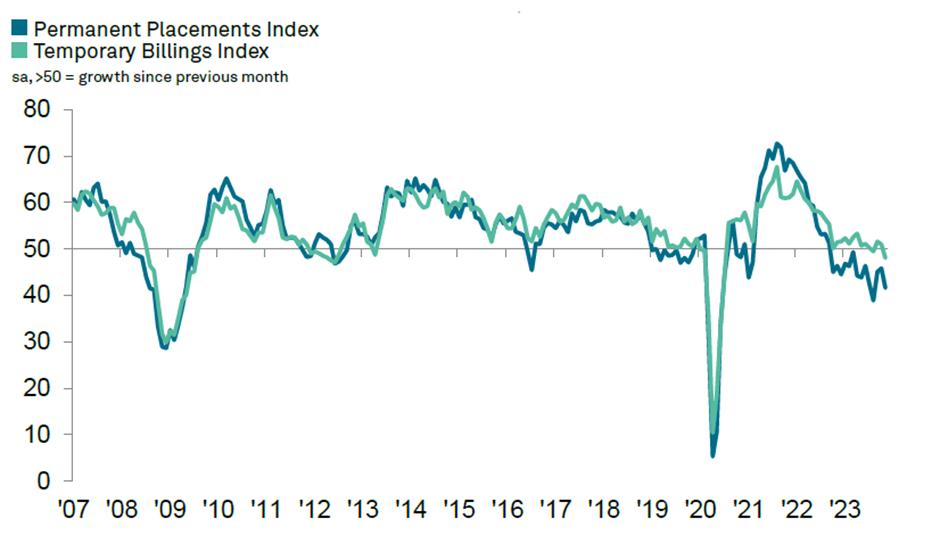

Throughout 2023, permanent hiring has been in steady decline whilst temporary billings has been either flat or growing only a little. As we can see in the UK Report on Jobs graph below:

Projects such as HS2 being cancelled from Phase 2 onwards and new housing projects being delayed has only heightened the challenging labour market for a variety of recruitment specialisms.

Although despite the downward trend, Neil Carberry, REC Chief Executive has said:

“Anecdote from REC members supports our client survey finding that employers are considering coming back to the market, but that in many cases the activity will be next year. So, while these figures represent a further slowdown in current hiring conditions, recruiters are more positive about the new year.”

Increase in costs

With the Bank of England increasing the base rate to the highest it’s been since 2008, money isn’t cheap. Which in turn, has led to recruitment agencies finding costs rising in their supply chain and a greater pressure on cashflow. With increased competition in the marketplace, end clients will also be looking to reduce their expenditure with recruitment agencies too.

However, with inflation anticipated to level out in 2024 and return to normal levels by 2025, we can anticipate that costs will begin to become more manageable within the next couple of years.

Insolvencies on the rise

There has been a significant increase in insolvencies in 2023 and it’s not just been small or micro businesses, some larger more established businesses have also folded. Allianz Trade reported that in Q2 2023, there were 7,101 business that entered insolvency. This isn’t expected to slow down until Q3 2024 and makes it clear that having bad debt insurance in place prior to placing candidates is a lifeline to recruitment businesses. In addition, having solid credit control and visibility on credit limits and aged debt is a way of managing exposure.

Heading into 2024, recruitment businesses can use the lessons taught from the challenges this year to their advantage:

“It’s not the strongest species that survive, nor the most intelligent, but the most responsive to change.” — Charles Darwin

Let’s chat about

your business needs

Get in touch and find out how we can take your recruitment business to the next level. You can book an appointment or simply give our team a call on 01305 233 178.